Fund now focuses 100 percent on corporate green bonds

Danske Invest has changed the framework for the Global Corporate Sustainable Bond fund, so that it can only invest in corporate green bonds issued to finance projects that support one or more of the UN's Sustainable Development Goals.

The fund will also change its name to *European Corporate Green Bond.

"Our change means that the fund is now 100 percent focused on corporate green bonds issued to finance green projects. When you invest in the fund, you are helping to finance and further the green transition," says Kristian Rumph Frederiksen, Portfolio Manager at Danske Bank Asset Management, which is behind the change in the fund's framework.

Up until now, about 60 percent of the fund was invested in both this type of green bonds and bonds issued for social purposes. Meanwhile, the remaining share was invested in traditional corporate bonds, where the bond issuer was assessed to meet Danske Bank's criteria for sustainable investments.

Mature market has paved the way for sharper focus

The change in the fund is largely due to the fact that the European market for green corporate bonds has grown steadily as more and more companies issue bonds to finance their green transitions.

For example, DSB issued green bonds for 500 million euros in September 2024 to partially finance the construction of new green workshops and acquire new electric carriages and train sets.

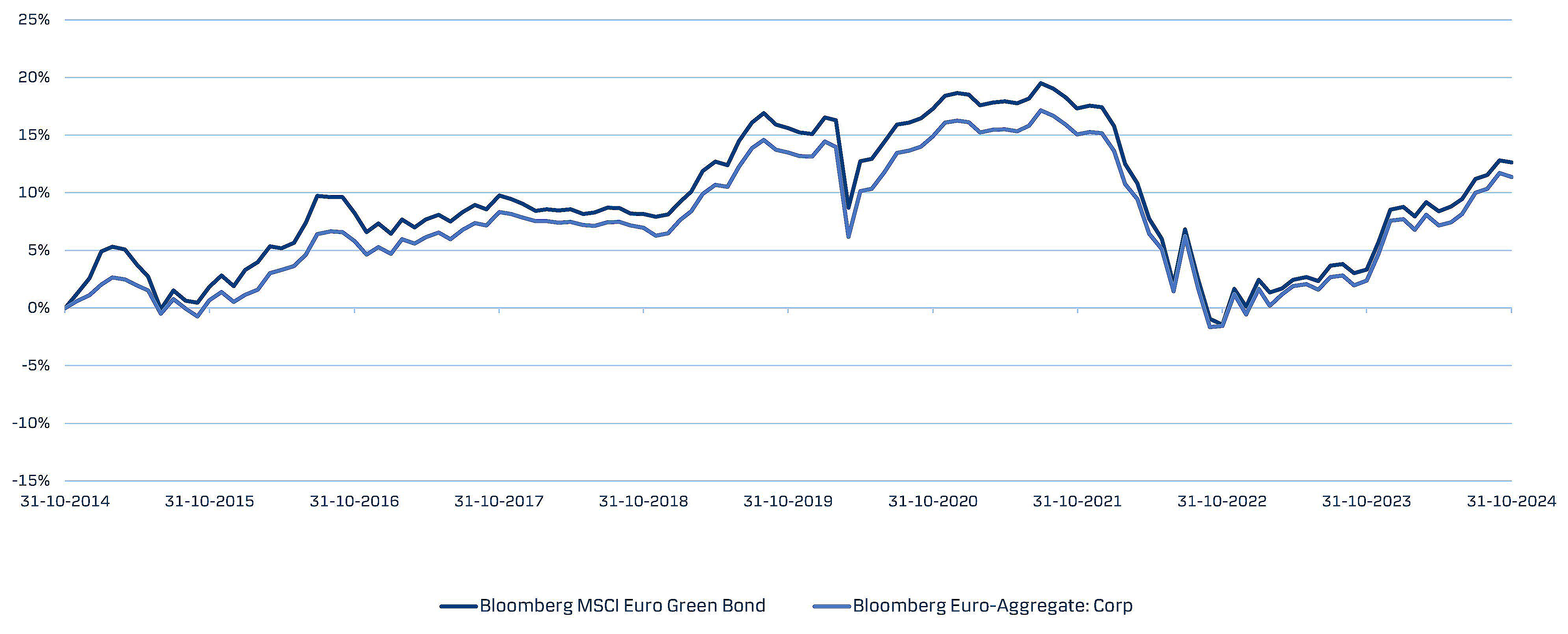

"The market for green bonds has really grown in the last decade – especially in Europe. It has moved from being a niche market to a mature market with a large and varied supply of bonds. Today, it is possible to compose a portfolio consisting of 100 percent green bonds, which have the same creditworthiness and offer the same effective interest rate as a comparable portfolio of traditional corporate bonds. It is this development that has driven the decision to focus the fund 100 percent on corporate green bonds and to focus on Europe," says Kristian Rumph Frederiksen.

Source: Bloomberg, November 12, 2024

Experienced people behind the fund

While Danske Bank Asset Management sets the framework for European Corporate Green Bond fund, including the sustainability strategy, it is the international investment manager Goldman Sachs Asset Management that has the investment responsibility.

This means that Goldman Sachs Asset Management decides which bonds the fund should invest in within the set framework. Goldman Sachs Asset Management and Danske Bank Asset Management also monitor that the allocation of financing from the green bonds are directed to the goals that the bonds were issued to finance.

"Goldmann Sachs Asset Management has followed the market for green bonds since the market's inception in 2007, when the first green bond was issued by the European Investment Bank. Over the years, they have built up a vast expertise on corporate green bonds, and therefore we are using them to select green bonds on behalf of the fund," says Torbens Badsberg Overgaard, Head of the Manager Selection team at Danske Bank Asset Management.

Danske Bank's model for green bond assessments can be accessed here.

*The full name of the fund is Danske Invest SICAV European Corporate Green Bond.

This publication has been prepared as marketing communication and does not constitute investment advice.

Information on historical performance information is not indicative of future performance or investment returns, that can be negative.

Please consult with your professional advisors about the legal, tax, financial or other matters relevant to the suitability and appropriateness of an investment to ensure that you understand it’s risks.

Please refer to the prospectus and the Key Information Document before making any final investment decision. A summary of investor rights can be obtained in English as well as more information on the sustainability aspects of the fund here. The decision to invest in the fund should take into account all of sustainable investment objectives of the fund as described in the prospectus.

Danske Invest Management A/S may decide to terminate the arrangements made for the marketing of its funds.